How Spendings Rebounded in Post Pandemic Days

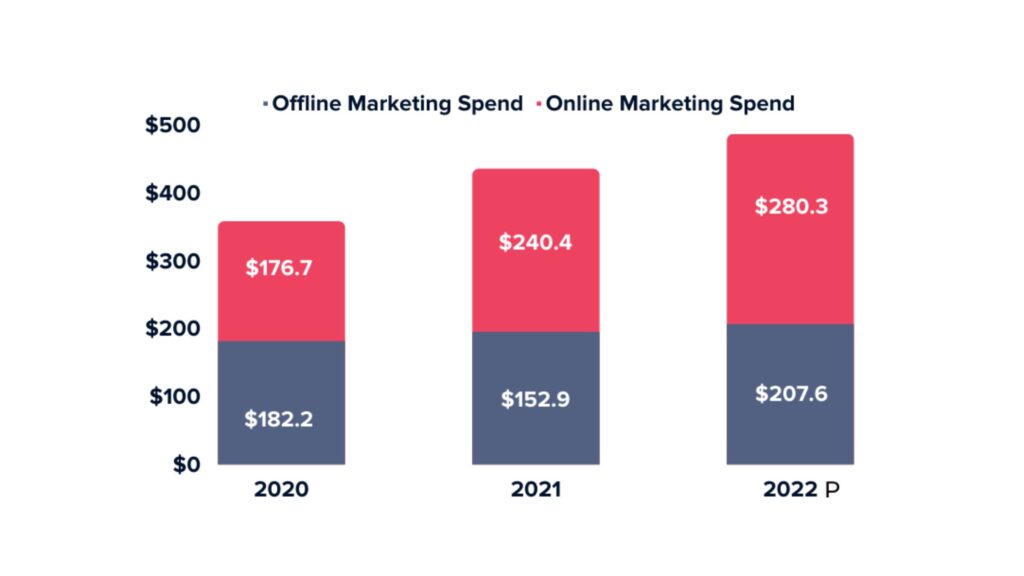

Yearly advertising spend has seen high volatility during the last four years; with 2020 showing a marked decline in annual advertising and marketing spend by businesses in the US.

There has been a 4.8% decline of spend in 2020, this can be attributed to the considerable reduction in both offline and online advertising spend due to the uncertainties caused by the pandemic.

Interestingly, though there was an overall decline in marketing spend, both online and offline spendings were roughly equal in 2020.

With covid restrictions being eased, the shift to pre-pandemic spending is well on the way; with offline marketing taking a greater precedence within the marketing mix. It’s predicted that in 2022 businesses will spend 45% of their marketing budget allocation on offline methods, whereas the rest of their budget (55%) will be accounted towards their online counterparts.

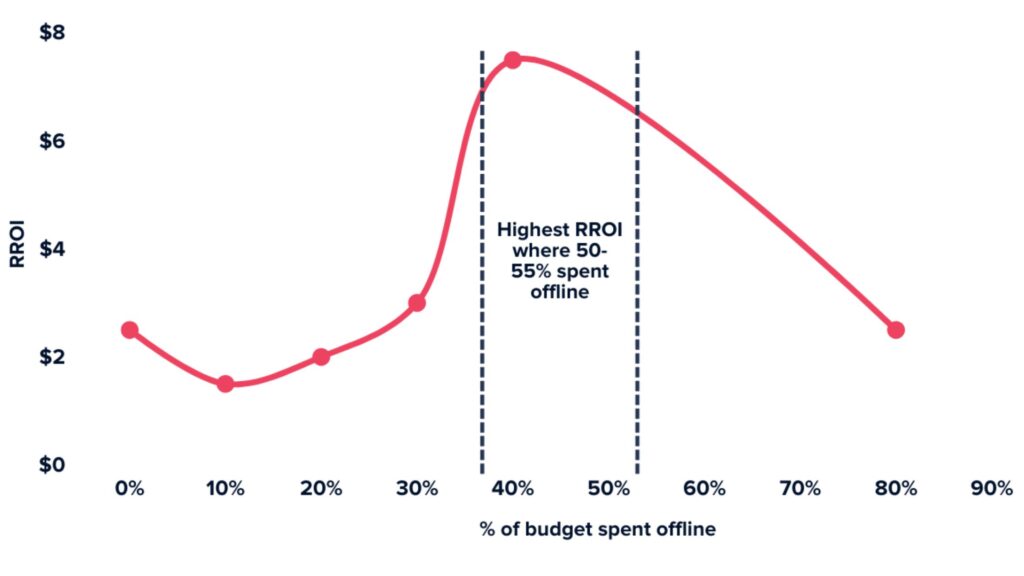

Data suggests businesses get the maximum marketing ROI when spending at least 50-55% on offline marketing. This leads us to the conclusion that it’s a combination of online and offline strategies that bear the maximum return for businesses.

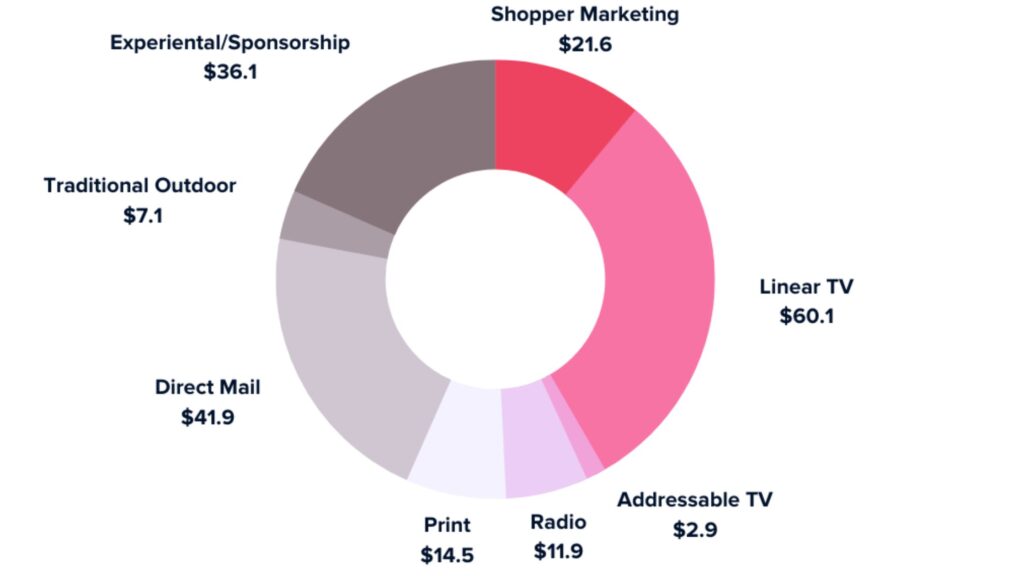

Where do marketers plan to spend offline

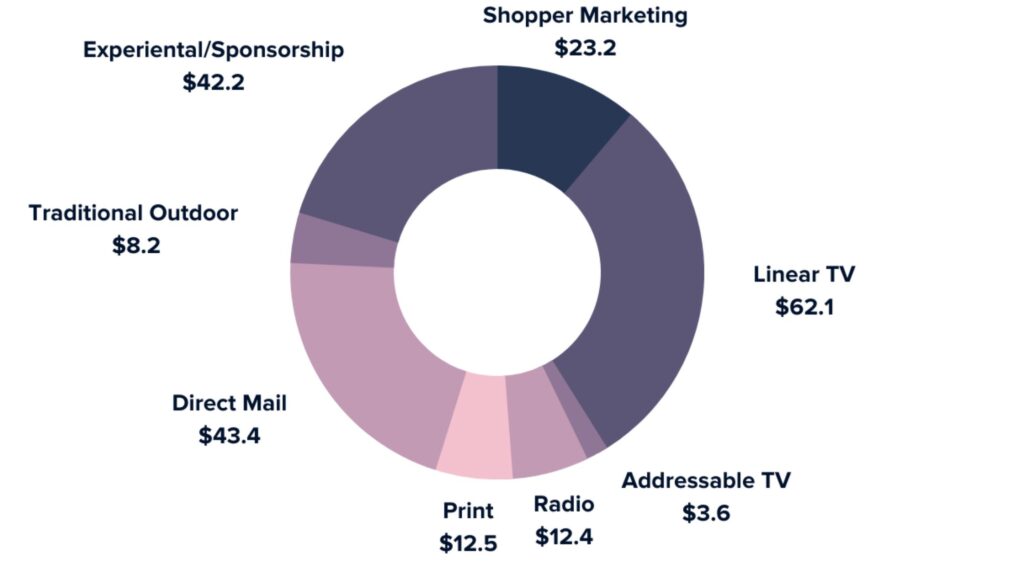

Unfortunately, the threats of Covid aren’t over yet, However, there is an increasing demand for offline marketing as people have started accepting the new normal.

It’s expected that offline marketing will see a large increase in annual spend. $207.6 billion investment is predicted for 2022.

Interestingly, 21% of spend will come from US businesses, around 43.4 billion of annual marketing spend will be focused around direct mail while an additional 10% on print and traditional OOH advertising.

What History Tells Us?

Importance of Direct Mail

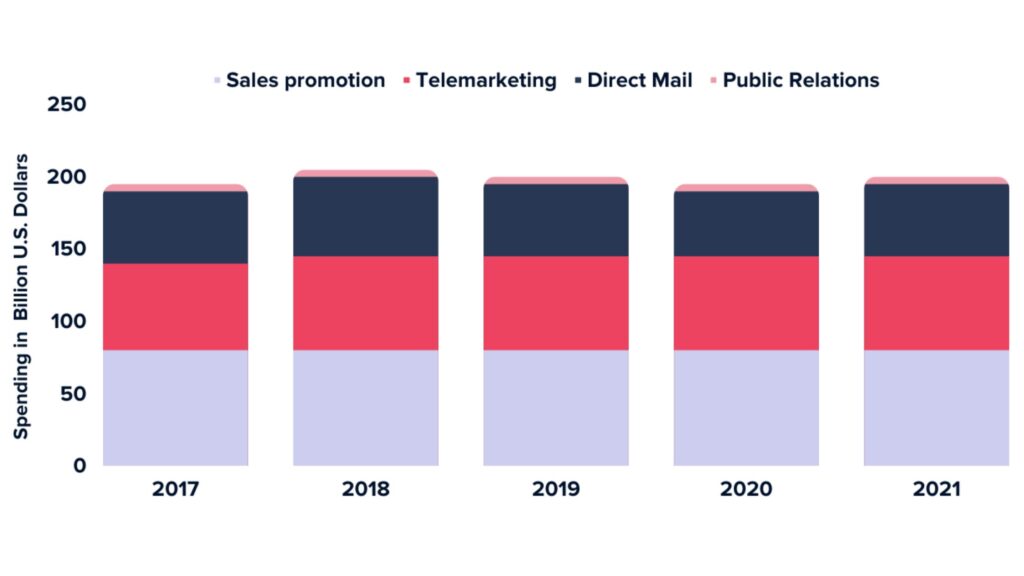

US businesses have consistently spent an equal share of their marketing budget on Direct Mail distribution. The figures show that marketing spend on direct mail have not only stayed consistent but have also increased YoY.

In 2021, marketing spend has seen a strong rebound, direct mail and traditional outdoor advertising spending has seen a huge uplift, with the former registering a 10.4% increase and the latter 9%.

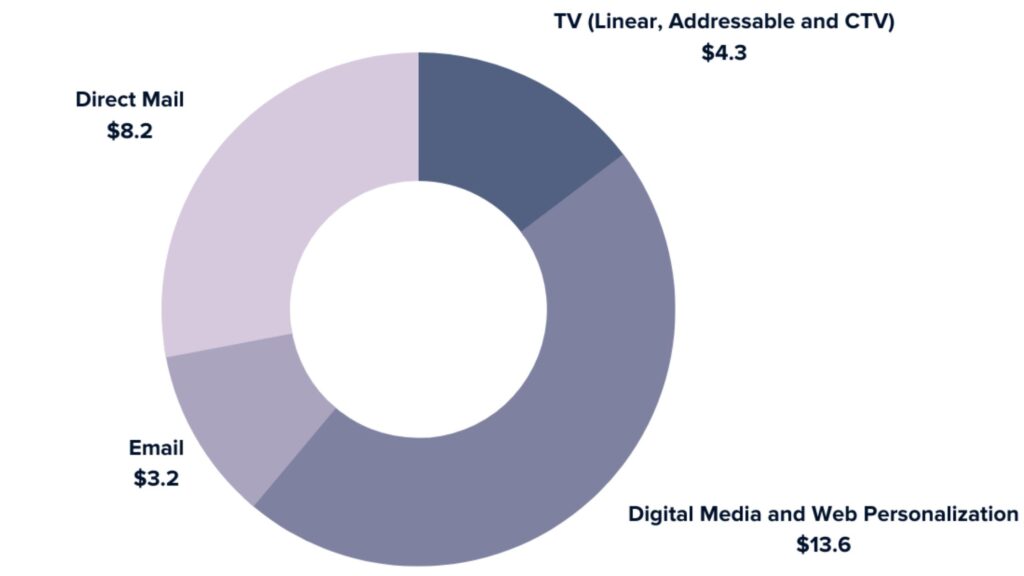

Robust Expansion in Spendings on Identifying Customer Demographics

The success of any marketing activity, be it online or offline, depends on the accuracy of customer demographics.

Post-COVID, businesses are showing an increased interest in data, identity, services and platform spending. All this points to the importance of customer demographics and customization of the services to match the specific needs of target users. This has been reflected by a 4.7% increase in the use of direct mail, which in effect has seen a positive rebound from 2020.

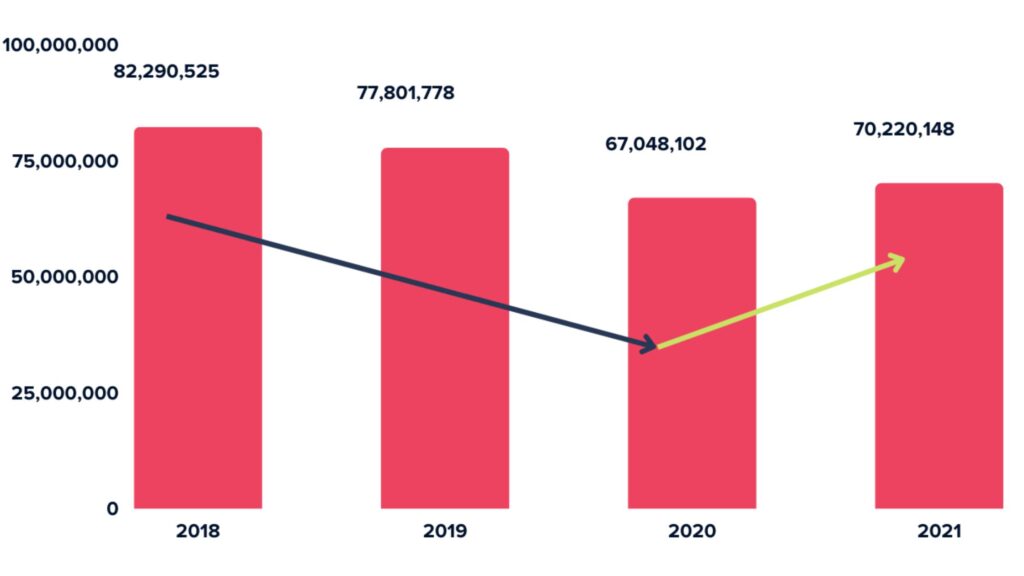

Since 2018, there has been a general decline in direct mail volume, the renewed interest in data, identity and platform expansion has helped it bounce back with a 4.7% increase in 2021 in comparison to 2020.

Direct Mail Contribution

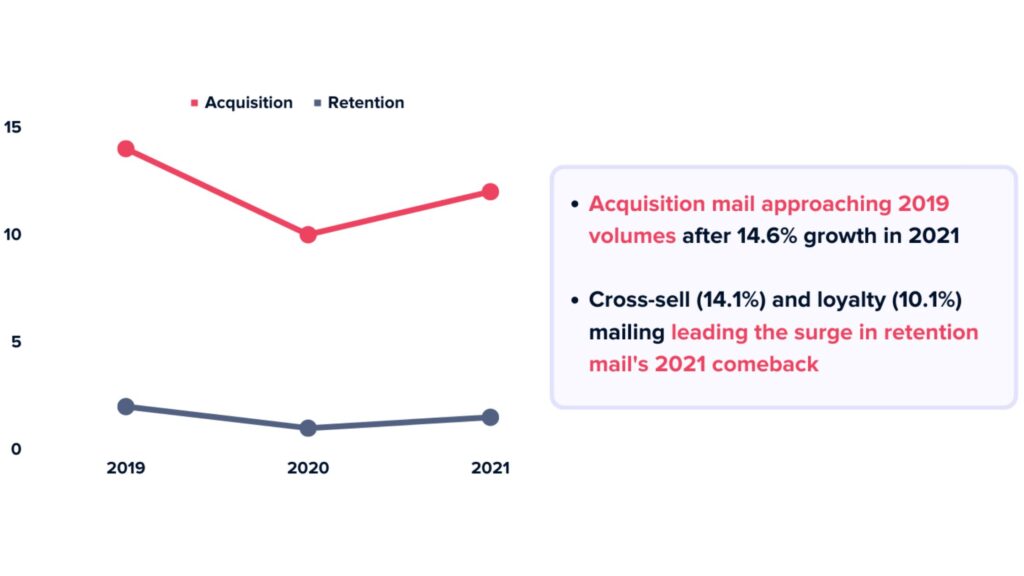

There was a significant reduction in acquisition and retention spend in direct mail marketing during 2020. However, 2021 looks prosperous in this respect as it rebounded with a 14% growth. It’s expected to reach and go above pre-pandemic figures in 2022.

Follow-up and renewal mailing is experiencing the sharpest declines across retention formats, with the former incurring a -25.7% decline and the latter -23.4%.

What prompted the growth in 2021 was the 14.1% increase in Cross-sell and 10.1% increase in loyalty mailing.

Marketing Priorities of CMOs in 2021

A significant number of CMOs believe that data and analytics profoundly impact their marketing strategies, spending, and customer acquisition programs.

43% of CMOs who participated in the survey from the United States said they prioritized technology, data and analytics as part of their marketing activities for 2021.

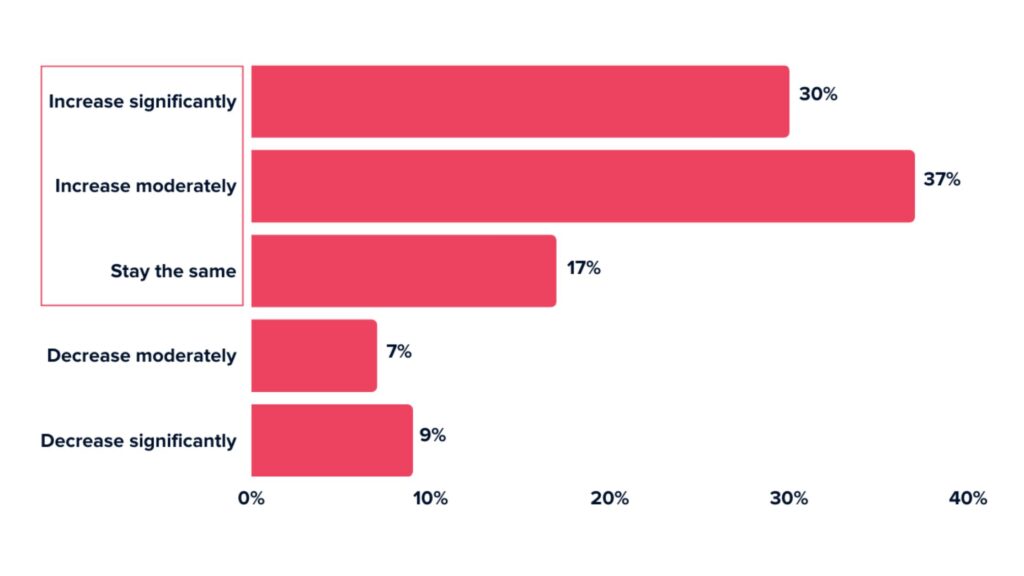

67% of marketing professionals in the United States who took part in the survey said they planned to increase their spending on marketing technology in 2022 and beyond.

- 30% planned to increase it significantly.

- 37% planned to increase it moderately.

Only 16% of marketing professionals said they would consider decreasing the marketing spending, whereas 17% said they intend to keep the marketing spending the same as 2021.